See what 100+ travel leaders say about hotel program challenges. Get the white paper

We surveyed 100+ travel leaders on their challenges with hotel programs. Here's what they said.

Read the white paper

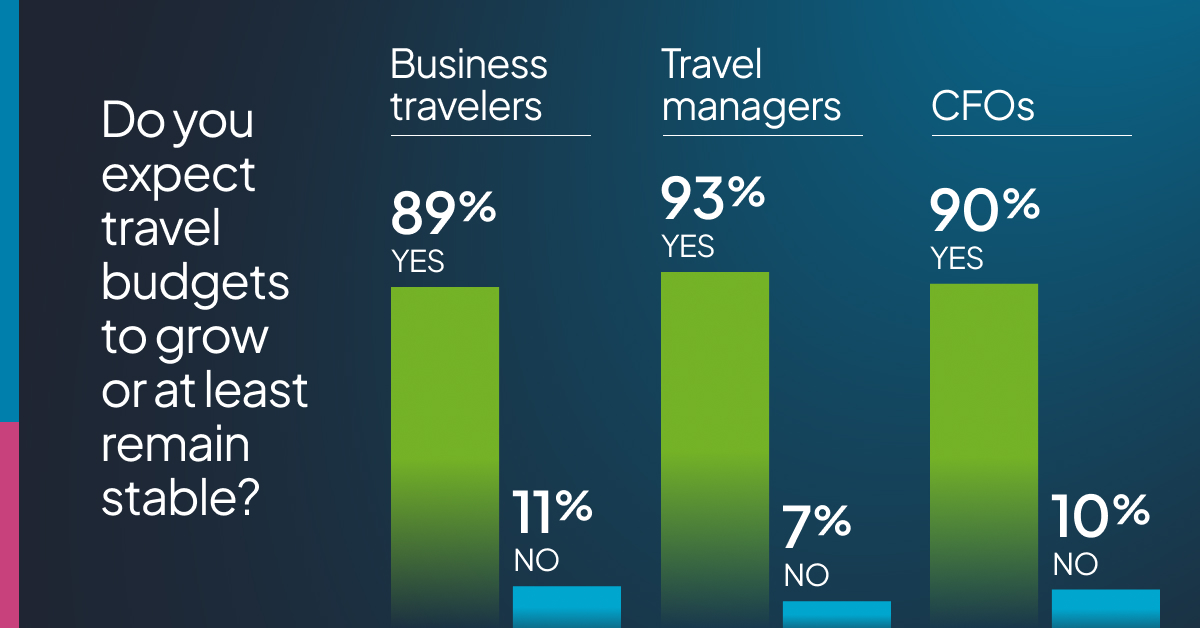

This year, SAP Concur’s Global Business Travel Research Report captures sentiment across travelers, travel managers, and CFOs. It documents that 55% of travelers say business travel is essential to do their jobs, and that budgets are largely expected to increase or stay the same—89% of travelers, 93% of travel managers, and 90% of CFOs report no planned cuts. The research also flags five forces shaping decisions in 2025: digital tools don’t replace travel, budgets are steady, “travelscrimping” is real, safety concerns are meaningful, and AI/cybersecurity are changing the game.

So where does this leave travel leaders? The following results tell a clear story.

Across all three cohorts, the majority anticipate no cuts to travel budgets: 89% of travelers, 93% of travel managers, and 90% of CFOs. Yet the same section explains why that doesn’t automatically translate to comfort or value: travel costs rose sharply in recent years, prompting companies to consolidate trips and cut unnecessary travel.

As one travel leader put it, “Suppliers have the upper hand because people are doing more leisure travel, which affects the cost of hotel accommodations and seats on planes” (Report, p. 4).

The report also highlights a persistent funding gap. Sixty-nine percent of travel managers say the company’s budget doesn’t reflect travel’s importance to success, and 81% of CFOs say budget limits keep employees from traveling as much as needed to be effective. Those tensions directly shape program design and traveler sentiment.

Rather than sweeping policy changes, many employees experience a series of small cutbacks the report calls “travelscrimping.” In the past 12 months, 30% of travelers report reduced access to business/premium class, 30% report fewer overnights to avoid long day trips, and 26% report less willingness to pay for a nonstop. At the same time, 84% say they spend more freely on company-funded trips than leisure travel, and a striking 85% are willing to use personal funds to improve comfort.

These are not isolated anecdotes—60% of travelers, 59% of managers, and 59% of CFOs report that travelscrimping is being implemented. The behavior underscores why clear, transparent funding rules and realistic expectations are essential for compliance and morale.

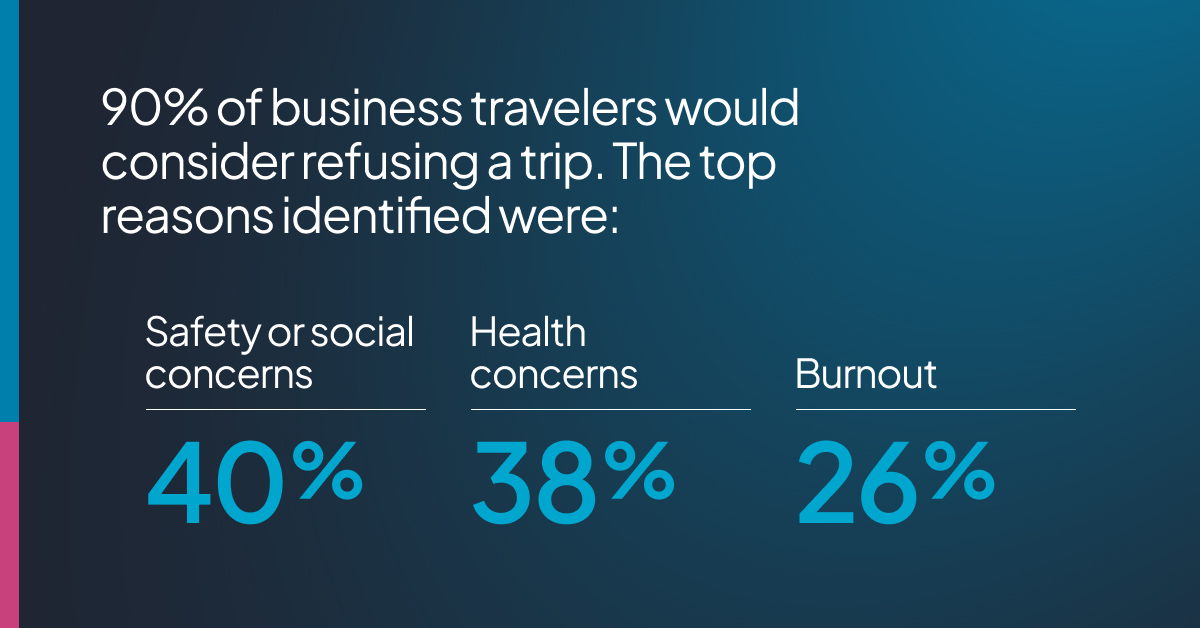

The report is unambiguous: 58% of travelers express concern about flight safety, and 16% say the concern makes them hesitant to fly for work at all (rising to 27% in the Middle East and 4% in Japan). Overall, 90% say they would consider refusing a trip; the top reason is safety or social concerns (40%), followed by health concerns (38%) and burnout (26%).

One global travel manager captures the feeling: “Aviation safety is a huge concern. Will the plane take off? Will I get there? How am I getting home?” (Report, p. 9).

Reliability is part of the same story: one in five travelers would refuse an itinerary if it required a connection, reflecting concerns about missed flights and getting stranded somewhere they don’t feel safe. For CFOs, 45% rank employee reluctance to travel right alongside geopolitical tensions as a top business risk—another signal that duty-of-care, routing choices, and traveler autonomy matter.

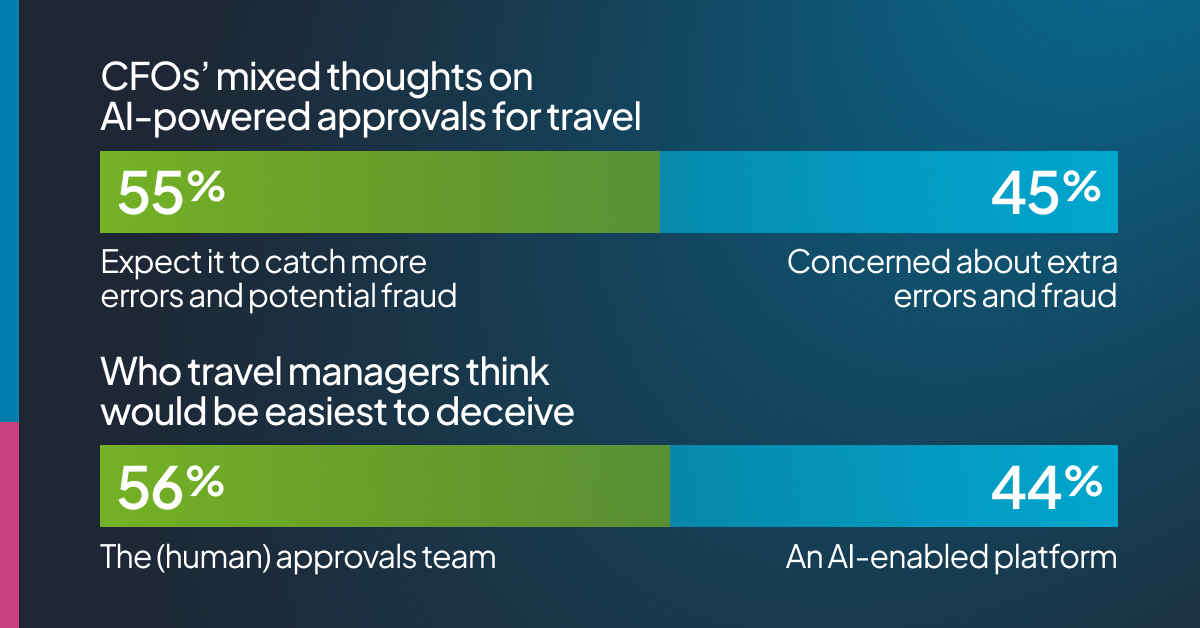

Generative tools have made fake receipts easier to create, and 75% of travelers believe coworkers are at least “a bit likely” to use AI to falsify expenses (82% in the U.S.; 58% in Japan). Yet there’s optimism on the control side: 55% of CFOs expect AI to catch more errors and fraud than traditional methods. Travelers themselves say the human approvals team (56%) would be easier to deceive than an AI-enabled platform (44%)—a telling vote of confidence in automated checks.

“If the program is not embracing AI, it’s going to be behind,” says Paula Finn, a global travel and expense manager (Report, p. 12).

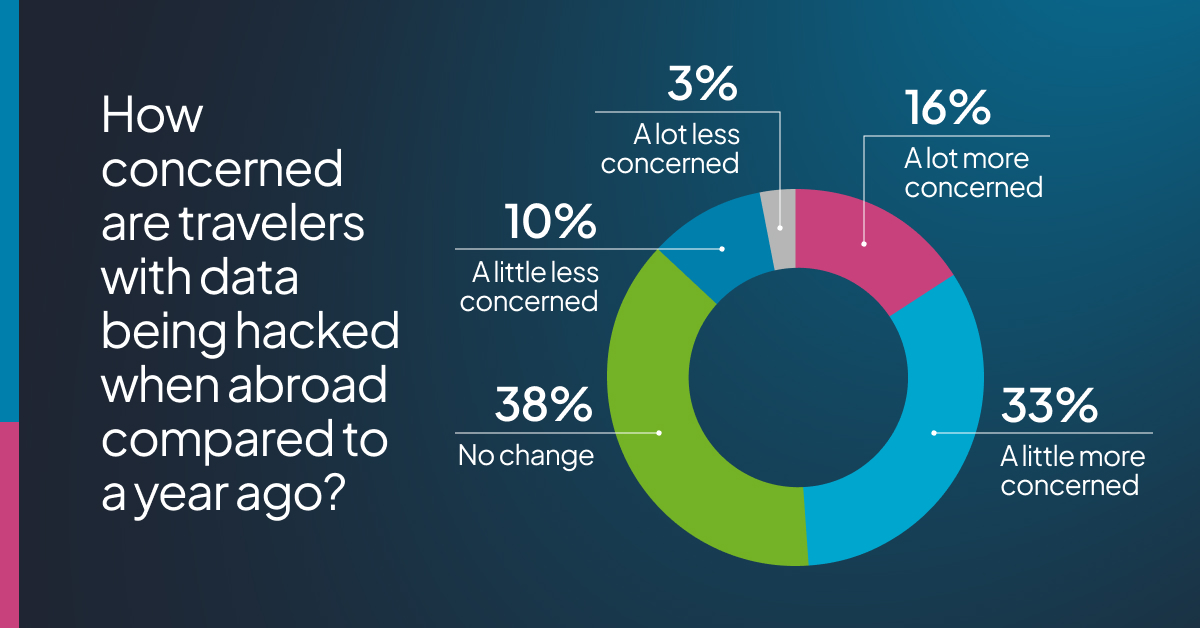

Cyber risk has become a traveler issue, not just an IT concern. Forty-nine percent of travelers report increased concern about cyber threats while abroad, and a majority of travel managers (56%) say their companies have already updated cybersecurity guidelines; another 27% are reviewing changes. These shifts validate the need to address data-handling, device hygiene, and network choices in trip planning and policy.

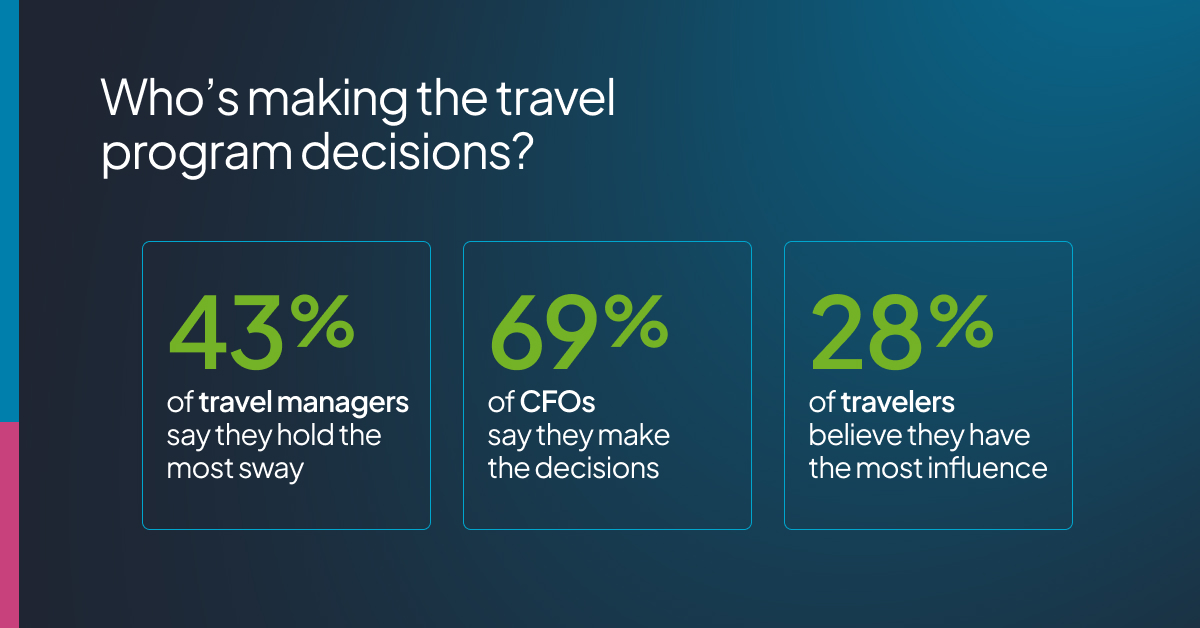

Decision rights are contested. Forty-three percent of travel managers say they hold the most sway over policy changes, but 69% of CFOs say CFOs make the decisions. Only 9% of CFOs and 16% of managers see traveler input as most influential, even though 28% of travelers believe it’s the travelers who shape policy. This dynamic puts a premium on cross-functional governance and clear ownership.

In practical terms, the findings translate into a focused set of moves across policy, care, suppliers, and controls to keep travelers moving while tightening risk.

Policy and budget

Start by aligning money with mission: clear, codified funding rules reduce gray areas that drive leakage, inequity, and frustration.

Duty of care and traveler confidence

Turn discretion into policy—affirm refusal rights, favor safer routings, and embed cyber hygiene so confidence is designed in, not assumed.

Supplier and sustainability strategy

With budgets steady but costs elevated, prioritize partners for reliability and wellbeing while meeting finance’s growing sustainability signals.

Digital, AI, and controls

Deploy automation where it cuts risk and friction, and pair it with transparent guardrails and human oversight to earn trust.

Use this short list to convert the report’s themes into concrete, near-term changes you can implement this quarter.

If you’re ready to turn steady budgets into measurable value, Christopherson Business Travel can help. Meet with a CBT expert to complete a program assessment, refresh policy and duty of care, realign supplier strategy, and modernize AI-assisted controls that protect spend and traveler confidence—without adding friction.

Are business travel budgets increasing in 2025?

Yes—89% of travelers, 93% of travel managers, and 90% of CFOs expect budgets to increase or stay the same.

What is “travelscrimping”?

A set of small cutbacks to stretch budgets, such as reduced access to premium cabins (30%), fewer overnights (30%), and less willingness to pay for nonstops (26%).

Why might a traveler refuse a trip?

90% would consider refusing, primarily due to safety or social concerns (40%), followed by health concerns (38%); 1 in 5 would refuse if a connection is required.

How do CFOs view AI in expense control?

55% expect AI to catch more errors and fraud than traditional methods; travelers say human approvers (56%) are easier to deceive than an AI platform (44%).

Are travelers more worried about cybersecurity now?

Yes—48% report increased concern while abroad; 56% of managers say their companies have already updated guidelines, with another 27% reviewing changes.

Is business travel still essential for employees?

Yes—55% of business travelers say travel is essential to do their jobs (Report, p. 3).

Are travel budgets increasing or decreasing?

Most stakeholders expect budgets to increase or stay the same: 89% of travelers, 93% of travel managers, 90% of CFOs.

How concerned are travelers about flight safety?

58% have some concern, and 16% hesitate to fly; 27% in the Middle East vs. 4% in Japan report hesitancy.

► You’ll also like: 9 common business travel challenges—and how we help solve them

We’ve curated some articles to keep you updated on all things Christopherson Business Travel.